Let’s be real—managing finances can be one of the most overwhelming aspects of running a business, especially here in Saudi Arabia. From tracking expenses to ensuring you’re compliant with all the local tax regulations, it can feel like you’re juggling a million things at once. I’ve been there, and I know that getting the right tools in place can make all the difference.

That’s where accounting software comes in. Trust me, having the right accounting software isn’t just a luxury; it’s a necessity. The best accounting software in Saudi Arabia can help you streamline everything—whether it’s invoicing clients, keeping track of expenses, or even preparing for tax season. And let’s face it, with VAT compliance being such a big deal here, you need software that can handle all those nitty-gritty details without breaking a sweat.

Choosing the wrong software, on the other hand, can lead to all sorts of headaches. Missed payments, incorrect tax filings, or even data breaches—nobody wants that. That’s why picking the best accounting software in Saudi Arabia is so crucial for your business’s success.

So, what’s the purpose of this post? Simple: I’m here to help you navigate the sea of options and find the perfect accounting software for your business. In this guide, I’ll walk you through the 20 best accounting software in Saudi Arabia, breaking down what makes each one stand out. By the end of this post, you’ll have a clear idea of which software fits your needs, budget, and business size.

Why Accounting Software is Essential for Businesses in Saudi Arabia

Introduction: The Importance of Financial Management

Let’s talk about the backbone of any successful business: financial management. No matter the size of your company—whether you’re a startup, an SME, or a large enterprise—keeping your finances in check is non-negotiable. In Saudi Arabia, this is especially true with the ever-evolving tax laws and the complexities of running a business in a growing economy. You need to have a solid grasp on your income, expenses, and overall financial health. And that’s where the best accounting software in Saudi Arabia comes into play.

Automating Accounting Tasks

One of the biggest advantages of using accounting software is automation. Gone are the days of manually inputting data into spreadsheets. Today’s software can automate everything from bookkeeping to invoicing and even tax preparation. Imagine being able to send invoices with just a few clicks, automatically categorize expenses, and generate financial reports without lifting a finger. Sounds good, right? That’s exactly what the best accounting software in Saudi Arabia can do for you.

Compliance with Saudi Regulations

Now, let’s talk compliance. We all know how crucial it is to stay on top of Saudi tax laws. With VAT being a significant part of the financial landscape here, having software that can help you stay compliant is non-negotiable. The last thing you want is to run into issues with the authorities because your software didn’t calculate your VAT correctly. The best accounting software in Saudi Arabia will not only handle VAT but also ensure that all your financial dealings are in line with local regulations. This peace of mind alone makes the investment worthwhile.

Supporting Business Growth

Finally, let’s talk growth. As your business scales, your financial needs will become more complex. The beauty of great accounting software is that it can grow with you. Whether you’re adding new revenue streams, expanding to new markets, or hiring more staff, the best accounting software in Saudi Arabia will have the features you need to keep everything running smoothly.

Key Features to Look for in the Best Accounting Software in Saudi Arabia

User-Friendly Interface

Nobody wants to waste time trying to figure out how to use complicated software. One of the first things you should look for in the best accounting software in Saudi Arabia is a user-friendly interface. The software should be intuitive, easy to navigate, and not require a degree in accounting to operate. After all, the whole point of using accounting software is to make your life easier, not harder.

VAT Compliance

VAT is a big deal here in Saudi Arabia, so it’s absolutely essential that any accounting software you choose is VAT-compliant. You don’t want to be scrambling to figure out how much VAT you owe at the end of the quarter. The best accounting software in Saudi Arabia will handle all the VAT calculations for you, ensuring you stay compliant with the law. This feature alone can save you hours of stress and potentially costly mistakes.

Multi-Currency Support

If your business deals with international clients or suppliers, you’ll definitely want software that supports multiple currencies. The best accounting software in Saudi Arabia will make it easy to manage transactions in different currencies without confusing your accounts. This feature is especially useful for businesses that are looking to expand their reach beyond the Kingdom.

Cloud-Based vs. On-Premise

When it comes to choosing between cloud-based and on-premise solutions, it really depends on your business needs. Cloud-based software offers the flexibility of accessing your accounts from anywhere, which is perfect if you’re always on the go. On the other hand, on-premise solutions might be better for businesses that require more control over their data. The best accounting software in Saudi Arabia will offer options that fit both models, allowing you to choose what works best for you.

Mobile Access

In today’s fast-paced world, having mobile access to your accounting software is more important than ever. Whether you’re at a client meeting, traveling, or just away from your desk, being able to manage your finances on the go is a game-changer. Look for the best accounting software in Saudi Arabia that offers robust mobile apps with all the key features you need at your fingertips.

Customer Support

Last but certainly not least, reliable customer support is a must. You don’t want to be stuck with a technical issue and no one to help you resolve it. The best accounting software in Saudi Arabia will offer top-notch customer support, preferably in Arabic, so you can get the help you need when you need it. Whether it’s via phone, chat, or email, having access to support can make all the difference in your experience with the software.

Criteria for Selecting the Best Accounting Software in Saudi Arabia

Affordability

Let’s face it—budget matters. While you want software that meets all your needs, it also has to be affordable, especially if you’re a small business or a startup. The best accounting software in Saudi Arabia will offer a range of pricing options that won’t break the bank but still deliver the features you need. Keep an eye out for software that offers flexible pricing plans, so you can scale as your business grows.

Scalability

Speaking of growth, scalability is key. You don’t want to invest in software that you’ll outgrow in a year or two. The best accounting software in Saudi Arabia will be able to handle your business’s increasing complexity as you expand. Whether you’re adding new employees, launching new products, or entering new markets, your software should be able to keep up.

Integration Capabilities

In today’s digital age, your accounting software shouldn’t operate in isolation. It should integrate seamlessly with other business tools like your CRM, inventory management, or e-commerce platforms. The best accounting software in Saudi Arabia will offer robust integration capabilities, allowing you to create a unified system that streamlines all your operations.

Security

Security is non-negotiable, especially when dealing with sensitive financial data. Saudi businesses need to prioritize software that offers top-tier security features. Look for the best accounting software in Saudi Arabia that includes data encryption, two-factor authentication, and regular security updates to protect your information from cyber threats.

Customer Reviews

Finally, don’t underestimate the power of customer reviews. Hearing from other businesses who have used the software can give you valuable insights into its strengths and weaknesses. When evaluating the best accounting software in Saudi Arabia, take some time to read reviews and ratings to ensure you’re making an informed decision.

Alright, we’ve covered a lot of ground so far, and now it’s time to dive into the real meat of this post: The 20 Best Accounting Software in Saudi Arabia. In the next section, I’ll be breaking down each option, highlighting the features that make them stand out, and explaining why they’re the top choices for businesses in the Kingdom. So, grab a cup of coffee, and let’s get into it!

The 20 Best Accounting Software in Saudi Arabia

Alright, let’s get to the heart of the matter—the list of the 20 best accounting software in Saudi Arabia. I’ve compiled this based on the features and criteria we discussed earlier, like VAT compliance, multi-currency support, user-friendly interfaces, and, of course, how well they cater to the unique needs of businesses here in Saudi Arabia. Whether you’re a freelancer, a small business, or a large enterprise, I’ve got you covered.

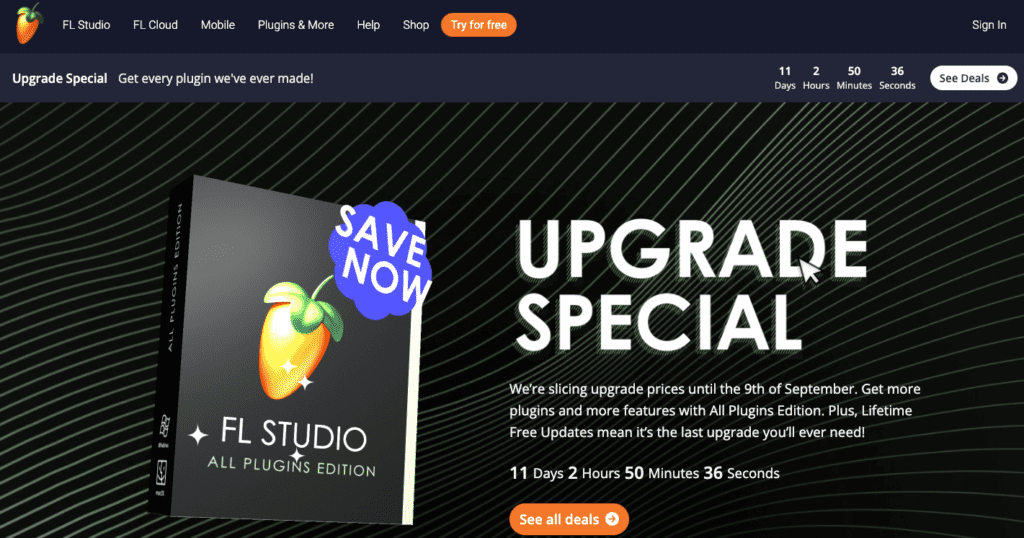

1. Zoho Books – Best Accounting Software in Saudi Arabia

Features:

- VAT Compliance: Zoho Books is fully compliant with Saudi VAT regulations, making it a top choice for businesses needing to stay on top of their tax obligations.

- Multi-Currency Support: Ideal for companies dealing with international clients, Zoho Books allows you to manage transactions in multiple currencies seamlessly.

- Integration with Zoho Ecosystem: If you’re already using other Zoho products, the integration is smooth and hassle-free, giving you a unified business management experience.

Pros:

- Affordable Pricing: Zoho Books offers great value for money, especially for small to medium-sized businesses.

- Comprehensive Features: It’s packed with features without being overwhelming.

- Customizable: You can tailor the software to fit your business needs perfectly.

Cons:

- Limited Payroll Features: Payroll management is somewhat basic compared to other software.

- Steeper Learning Curve: It might take some time to get the hang of all its features.

- Customer Support: While good, it could be more responsive.

Price Range: Starts at around SAR 40/month.

Best For: Small to medium-sized businesses looking for an affordable, VAT-compliant solution.

2. QuickBooks Online – Best Accounting Software in Saudi Arabia

Features:

- Cloud-Based: Access your accounting data anytime, anywhere, making it ideal for businesses with remote teams.

- Multi-Currency Support: QuickBooks handles multiple currencies, which is perfect for businesses dealing with international transactions.

- Easy Integration: QuickBooks integrates seamlessly with a wide range of apps, from CRM tools to e-commerce platforms.

Pros:

- User-Friendly Interface: Even if you’re not a numbers person, QuickBooks makes accounting straightforward.

- Widely Used: It’s one of the most popular choices for SMEs in Saudi Arabia, which means plenty of resources and support available.

- Automation: Automate repetitive tasks like invoicing and bill payments, saving you time.

Cons:

- Pricing: It’s a bit on the pricier side, especially for smaller businesses.

- Limited Inventory Features: If you need advanced inventory management, you might need an add-on.

- Support: While generally good, it can sometimes take a while to get help.

Price Range: Starts at around SAR 60/month.

Best For: SMEs looking for a reliable, easy-to-use accounting solution with strong cloud capabilities.

3. Xero – Best Accounting Software in Saudi Arabia

Features:

- Real-Time Data Access: With Xero, you get up-to-date financial data whenever you need it, helping you make informed decisions.

- VAT Compliance: Like the other top picks, Xero is fully VAT-compliant, which is essential for businesses in Saudi Arabia.

- Robust Reporting Tools: Xero offers detailed financial reports that help you analyze your business performance.

Pros:

- Scalability: Xero grows with your business, offering features for both small businesses and larger enterprises.

- Mobile Accessibility: Manage your finances on the go with Xero’s mobile app.

- User-Friendly: Xero’s interface is clean and intuitive, making it easy to navigate.

Cons:

- Price: It’s slightly more expensive than some competitors.

- Add-Ons: To unlock full functionality, you may need to invest in additional apps or services.

- Customer Support: Response times could be faster.

Price Range: Starts at around SAR 80/month.

Best For: Growing businesses that need robust accounting features and real-time data access.

4. Sage 50cloud

Features:

- Advanced Reporting: Sage 50cloud offers detailed financial reports, giving you deep insights into your business.

- Inventory Management: This feature is particularly strong, making it a great option for businesses with complex inventory needs.

- Cloud Integration: Although it’s traditionally desktop software, Sage 50cloud offers cloud integration for added flexibility.

Pros:

- Strong Reputation: Sage has a long-standing reputation in the Saudi market for reliability.

- Comprehensive Features: It’s packed with advanced features that are ideal for more complex businesses.

- Security: Sage 50cloud offers top-notch security, ensuring your financial data is well-protected.

Cons:

- Learning Curve: It’s not as intuitive as some of the other options, so expect to spend some time learning the ropes.

- Cost: Sage 50cloud is on the higher end of the price spectrum.

- Limited Mobile Functionality: While it offers some cloud integration, the mobile features are not as robust as fully cloud-based options.

Price Range: Starts at around SAR 100/month.

Best For: Established businesses with complex accounting needs that value detailed reporting and inventory management.

5. FreshBooks

Features:

- Invoicing: FreshBooks makes invoicing a breeze with customizable templates and automation features.

- Expense Tracking: Easily track your expenses and categorize them for tax purposes.

- Time Tracking: A great feature for freelancers or businesses that bill by the hour.

Pros:

- Simplicity: FreshBooks is incredibly easy to use, making it ideal for non-accountants.

- Mobile App: The mobile app is excellent for managing your finances on the go.

- Customer Support: FreshBooks is known for its responsive and helpful customer service.

Cons:

- Limited Features for Larger Businesses: While great for small businesses and freelancers, FreshBooks may lack the advanced features needed by larger companies.

- Price: Slightly more expensive than similar simple accounting tools.

- Limited Integrations: Doesn’t integrate as well with other business tools as some competitors.

Price Range: Starts at around SAR 50/month.

Best For: Freelancers and small businesses that need an easy-to-use, invoicing-focused solution.

6. Wave

Features:

- Free Accounting Tools: Wave offers a comprehensive set of accounting tools for free, making it highly appealing to startups.

- Invoicing: Send professional invoices without paying a dime.

- Receipt Scanning: Snap photos of your receipts and keep your records organized.

Pros:

- Cost: It’s hard to beat free, especially for startups on a tight budget.

- Simple Interface: Wave’s user interface is clean and easy to navigate.

- Good for Basic Accounting: Wave handles basic accounting needs well, making it ideal for small businesses.

Cons:

- Limited Features: You’ll miss out on more advanced features like inventory management.

- Customer Support: The free plan doesn’t offer as robust customer support as paid options.

- Scalability: Not the best option for businesses that plan to scale significantly.

Price Range: Free (with optional paid add-ons).

Best For: Startups and small businesses looking for free, basic accounting software.

7. Odoo Accounting

Features:

- Integrated with Odoo ERP: Odoo Accounting is part of the larger Odoo ERP system, which offers a range of business management tools.

- Customizable: You can tailor Odoo to fit your business’s unique needs.

- VAT Compliant: Fully compliant with Saudi VAT regulations.

Pros:

- Flexibility: Odoo’s customization options make it a powerful tool for growing businesses.

- Modular: You can start with accounting and add other Odoo modules as your business expands.

- Community Support: Odoo has a strong open-source community that offers support and resources.

Cons:

- Complexity: Odoo can be complex to set up and configure, especially for smaller businesses.

- Cost: While the basic version is free, the paid modules can add up.

- Learning Curve: You may need some time to get used to all the features.

Price Range: Free for the basic version, with paid modules available.

Best For: Growing businesses that need a flexible, integrated solution.

8. Tally.ERP 9

Features:

- VAT Compliance: Tally is fully VAT compliant, which is essential for businesses operating in Saudi Arabia.

- Inventory Management: Tally offers strong inventory management features, making it ideal for businesses with complex stock needs.

- Payroll: Manage payroll with ease, keeping your staff payments in check.

Pros:

- Trusted in the Middle East: Tally has a strong reputation in the region, especially for handling complex accounting needs.

- Comprehensive Features: It’s a powerful tool that can handle almost all aspects of your business’s financial management.

- Cost-Effective: Given the features, Tally offers good value for money.

Cons:

- Not as User-Friendly: Tally can be a bit more complicated to use than some of the other options on this list.

- Limited Cloud Features: While it offers remote access, it’s not as fully cloud-based as other options.

- Customer Support: While generally good, it may lack the responsiveness of other software providers.

Price Range: Starts at around SAR 75/month.

Best For: Businesses in Saudi Arabia that need a robust accounting solution with strong inventory and payroll features.

9. Kashoo

Features:

- Simple Interface: Kashoo is designed with simplicity in mind, making it easy for small businesses to manage their finances.

- Multi-Currency: Like the others, Kashoo handles multi-currency transactions, ideal for businesses with international clients.

- Bank Reconciliation: Easily reconcile your bank statements with your accounting records.

Pros:

- Affordable: Kashoo is one of the more affordable options on this list, making it accessible to small businesses.

- User-Friendly: Even if you’re not an accounting pro, you’ll find Kashoo easy to navigate.

- Good for Small Businesses: If you’re running a small business, Kashoo covers all the basics without overwhelming you.

Cons:

- Limited Features: It’s not as feature-rich as some of the more advanced options on this list.

- Scalability: Kashoo might not grow with your business as well as other software.

- Customer Support: While good, it may not be as comprehensive as other providers.

Price Range: Starts at around SAR 35/month.

Best For: Small businesses needing a straightforward, affordable accounting solution.

10. ERPNext

Features:

- Open-Source: ERPNext is fully open-source, giving you complete control over customization.

- VAT Compliance: Compliant with Saudi VAT regulations, so you don’t have to worry about tax complications.

- Integrated ERP Features: Beyond accounting, ERPNext offers a full suite of ERP features, making it a comprehensive business management tool.

Pros:

- Cost-Effective: As an open-source solution, ERPNext can be very affordable, especially for businesses that don’t mind a bit of DIY.

- Community Support: There’s a strong community around ERPNext, offering plenty of resources and support.

- Customizable: Tailor the software to fit your specific business needs.

Cons:

- Complexity: ERPNext can be complex to set up and manage, especially if you’re not familiar with open-source software.

- Learning Curve: It may take some time to fully understand and utilize all of ERPNext’s features.

- Support: While the community is strong, official support may not be as responsive as paid options.

Price Range: Free for the open-source version, with paid hosting options available.

Best For: Businesses that want a cost-effective, customizable accounting solution with integrated ERP features.

11. Manager.io

Features:

- Free Accounting Software: Manager.io offers a robust accounting solution at no cost, making it accessible for small businesses and startups.

- VAT Reporting: It includes VAT reporting, essential for staying compliant with Saudi Arabia’s tax laws.

- Multi-Currency Support: Handles transactions in various currencies, which is great if your business deals with international clients.

Pros:

- Cost-Effective: Being free, it’s hard to beat in terms of value for money.

- Simple and User-Friendly: Despite being free, it’s designed to be intuitive and easy to use, even for those without accounting experience.

- Offline Access: You can use it offline, making it a solid option if you prefer not to rely solely on cloud-based solutions.

Cons:

- Limited Features: While it covers the basics, it may not offer the advanced features that larger businesses need.

- No Cloud Version: If you need access from multiple devices or locations, you’ll need to install it on each one.

- Customization: It’s not as customizable as some other software on this list.

Price Range: Free

Best For: Small businesses and startups looking for a free, simple accounting solution. with a focus on social selling and need an easy-to-use CRM solution.

12. Zoho Invoice

Features:

- Invoicing: Zoho Invoice excels at creating and managing professional invoices, making it easy to bill your clients.

- Expense Tracking: Keep track of your business expenses effortlessly.

- Online Payments: Integrated online payment options allow clients to pay you directly through the invoice.

Pros:

- Seamless Integration: Zoho Invoice integrates well with Zoho Books, offering a comprehensive accounting solution if you need more advanced features later.

- User-Friendly: The interface is clean and straightforward, making it easy to manage your invoicing and payments.

- Affordable: While not free, it’s reasonably priced for the features it offers.

Cons:

- Limited to Invoicing: It’s primarily focused on invoicing, so you’ll need additional software for full accounting features.

- Customization Limits: Although it’s flexible, there are some limits to customization, especially compared to more robust tools.

- Support: Support options are good but may not be as immediate or comprehensive as higher-priced solutions.

Price Range: Free for basic plan, with paid plans starting at SAR 37/month.

Best For: Freelancers and small businesses focused on invoicing and client payments.

13. Peachtree Accounting

Features:

- VAT Compliance: Peachtree is known for its detailed VAT reporting, crucial for businesses in Saudi Arabia.

- Payroll Management: Easily handle payroll within the software, reducing the need for separate payroll tools.

- Detailed Financial Reports: Get deep insights into your financial data with comprehensive reporting tools.

Pros:

- Established Software: Peachtree has been around for a long time, and it’s a trusted name in accounting.

- Comprehensive Features: It covers everything from basic bookkeeping to advanced financial management.

- Good for Growing Businesses: As your business scales, Peachtree can keep up with more complex needs.

Cons:

- Learning Curve: It might take some time to get used to all of its features, especially if you’re new to accounting software.

- Higher Price Point: Peachtree is more expensive than some of the other options on this list.

- Not Cloud-Native: While it offers cloud capabilities, it’s primarily desktop-based, which might not be ideal for everyone.

Price Range: Starts at SAR 140/month.

Best For: Established businesses that need detailed financial management and payroll features.

14. MYOB

Features:

- Tax Management: MYOB simplifies tax management, including VAT, making compliance easier.

- Reporting: Get detailed insights into your business with a variety of reporting options.

- Payroll: Handle employee payroll within the software, keeping everything in one place.

Pros:

- User-Friendly: MYOB is known for its easy-to-navigate interface, making it suitable for both beginners and experienced users.

- VAT Compliance: It’s compliant with Saudi VAT regulations, so you don’t have to worry about tax issues.

- Comprehensive Features: MYOB covers a wide range of accounting needs, from bookkeeping to payroll.

Cons:

- Pricing: It’s on the pricier side, especially for small businesses.

- Limited Customization: While it’s user-friendly, there’s less room for customization compared to other software.

- Customer Support: Some users have reported that support can be slow at times.

Price Range: Starts at SAR 110/month.

Best For: Small to medium-sized businesses looking for a comprehensive, user-friendly accounting solution.

15. Clear Books

Features:

- VAT Compliance: Clear Books ensures your business stays compliant with Saudi VAT regulations.

- Reporting: Access detailed financial reports to keep track of your business’s health.

- Payroll Management: Manage payroll within the software, reducing the need for additional tools.

Pros:

- Simplicity: Clear Books is designed to be simple and easy to use, making it a great choice for smaller businesses.

- VAT Compliant: It’s fully compliant with Saudi VAT laws, so you don’t have to worry about tax issues.

- Affordable: It’s priced competitively, offering good value for money.

Cons:

- Limited Features: While it’s great for small businesses, it might not offer all the features larger businesses need.

- Customization: It’s not as customizable as some other options on this list.

- Support: Customer support is good, but not as extensive as higher-priced competitors.

Price Range: Starts at SAR 90/month.

Best For: Small businesses that need a simple, VAT-compliant accounting solution.

16. Invoicera

Features:

- Invoicing: Invoicera shines when it comes to creating and managing invoices, perfect for businesses that need strong invoicing capabilities.

- Time Tracking: Keep track of billable hours easily, making it ideal for service-based businesses.

- Expense Management: Manage your expenses in one place, helping you keep track of your financials.

Pros:

- Flexible: Invoicera offers a lot of customization options, so you can tailor it to your business needs.

- Strong Invoicing Tools: If invoicing is your main concern, Invoicera is hard to beat.

- Affordable: It’s reasonably priced for the features it offers.

Cons:

- Limited Accounting Features: It’s primarily an invoicing tool, so you might need additional software for full accounting.

- Learning Curve: It can take a bit of time to get the hang of all its features.

- Customer Support: Support is good, but not always immediate, especially for more complex issues.

Price Range: Starts at SAR 40/month.

Best For: Freelancers and small businesses that need powerful invoicing tools.

17. NetSuite ERP

Features:

- Full ERP Integration: NetSuite isn’t just accounting software; it’s a full ERP system, which makes it ideal for larger businesses.

- Real-Time Data: Access real-time data across your entire business for better decision-making.

- Scalability: As your business grows, NetSuite can grow with you, making it a long-term solution.

Pros:

- Comprehensive: NetSuite covers all aspects of business management, not just accounting.

- Real-Time Insights: You get access to real-time data, which can be invaluable for making quick business decisions.

- Scalable: Whether you’re a mid-sized business or a large enterprise, NetSuite can scale to meet your needs.

Cons:

- Expensive: NetSuite is one of the more expensive options on this list.

- Complex: With so many features, it can be overwhelming to set up and manage.

- Support Costs: While support is available, it can add to the overall cost.

Price Range: Custom pricing, typically starts around SAR 2,800/month.

Best For: Larger businesses that need a comprehensive ERP solution.

18. KashFlow

Features:

- Invoicing: KashFlow makes it easy to create and send invoices, helping you get paid faster.

- VAT Reports: Stay compliant with VAT regulations in Saudi Arabia with detailed reporting.

- Payroll: Handle payroll within the software, making it easier to manage all aspects of your business finances.

Pros:

- User-Friendly: KashFlow is designed with simplicity in mind, making it easy to use.

- Affordable: It’s priced well for the features it offers, making it accessible to small businesses.

- VAT Compliant: You don’t have to worry about VAT issues with KashFlow, as it’s fully compliant.

Cons:

- Limited Advanced Features: It might not offer the advanced features that larger businesses need.

- Customization: There’s less room for customization compared to more complex tools.

- Support: Customer support is good, but not as comprehensive as some other software.

Price Range: Starts at SAR 60/month.

Best For: Small businesses that need a straightforward, VAT-compliant accounting solution.

19. Sage Business Cloud Accounting

Features:

- Cloud-Based: Sage Business Cloud offers the flexibility of cloud accounting, allowing you to access your financials from anywhere.

- VAT Compliance: It’s fully compliant with Saudi VAT regulations, ensuring you stay on the right side of the law.

- Integrations: Seamlessly integrates with other Sage products, providing a comprehensive business management solution.

Pros:

- Scalable: Sage Business Cloud can grow with your business, making it a long-term solution.

- Cloud Access: Access your financial data from anywhere, at any time.

- User-Friendly: It’s designed to be intuitive, making it easy to manage your business finances.

Cons:

- Pricing: It’s more expensive than some of the other options on this list.

- Limited Customization: While user-friendly, there’s less room for customization.

- Support: Customer support is good, but might not be as immediate as higher-end options.

Price Range: Starts at SAR 100/month.

Best For: Growing businesses that need a scalable, cloud-based accounting solution.

20. TurboTax Business

Features:

- Tax Management: TurboTax is known for its strong tax management capabilities, helping you stay compliant with Saudi tax laws.

- VAT Reporting: Includes features for VAT reporting, making it easy to manage your taxes.

- Integration with QuickBooks: If you’re already using QuickBooks, TurboTax integrates seamlessly, providing a complete accounting solution.

Pros:

- Strong Tax Features: TurboTax is one of the best when it comes to managing taxes.

- Easy to Use: The interface is user-friendly, making it easy to handle your taxes and accounting.

- Integration: Works well with QuickBooks, offering a more comprehensive solution.

Cons:

- Limited Features Outside of Tax: While it’s great for tax management, it may not offer all the accounting features you need.

- Pricing: It’s on the pricier side, especially when combined with QuickBooks.

- Customer Support: Support is good but might not be as immediate or extensive as some other options.

Price Range: Starts at SAR 180/month.

Best For: Businesses that need strong tax management features, especially those already using QuickBooks.

Honorable Mentions

Honorable Mentions

In addition to the top picks, there are several other noteworthy accounting software options worth considering for businesses in Saudi Arabia. These honorable mentions offer unique features that might align perfectly with your specific needs:

- Overview: A robust solution from Intuit designed for professionals who manage accounting for multiple clients.

- Key Features: Advanced tax management, client collaboration tools, and comprehensive reporting.

- Why It’s Honorable: Its strong tax features and professional-grade tools make it a solid choice for accountants and tax professionals.

2. Financio

- Overview: A cloud-based accounting software tailored for small to medium-sized businesses.

- Key Features: Automated invoicing, expense tracking, and financial reporting.

- Why It’s Honorable: Its user-friendly interface and affordability make it a great option for smaller businesses and startups.

- Overview: A versatile accounting solution that offers both desktop and cloud options.

- Key Features: Inventory management, payroll, and customizable reports.

- Why It’s Honorable: The flexibility of both desktop and cloud access can be ideal for businesses with varied needs.

- Overview: An earlier version of FreshBooks, still popular among freelancers and small businesses.

- Key Features: Invoice customization, expense tracking, and client management.

- Why It’s Honorable: Though it’s an older version, it remains a reliable tool for businesses seeking straightforward accounting solutions.

5. GnuCash

- Why It’s Honorable: Its open-source nature and no-cost model make it a great choice for those who prefer a customizable and community-supported tool.

- Overview: An open-source accounting software with a strong community backing.

- Key Features: Double-entry accounting, financial reporting, and multi-currency support.

How to Choose the Best Accounting Software for Your Business in Saudi Arabia

When it comes to selecting the best accounting software in Saudi Arabia for your business, there are a few key factors to consider to ensure you make the right choice.

Assess Your Business Needs: Start by evaluating what your business specifically requires from accounting software. Are you looking for basic invoicing and expense tracking, or do you need comprehensive financial management with VAT compliance and payroll features? Understanding your needs will help you narrow down your options and find software that fits your unique requirements.

Consider Future Growth: Think about where your business is headed. Choose software that can scale with you as your business grows. It’s essential to pick a solution that won’t just meet your current needs but will also accommodate future expansions and complexities.

Trial Versions and Demos: Most top accounting software providers offer free trials or demo versions. Take advantage of these to test the software in action. This hands-on experience can help you understand how user-friendly the software is and whether it integrates well with your existing systems.

Seek Local Recommendations: Don’t hesitate to ask other Saudi businesses for their recommendations. They can provide valuable insights and share their experiences with different software options. Local recommendations can be especially helpful as they often come from businesses that have similar needs and face the same regulations (semantically related keyword: “Saudi business recommendations”).

Final Thoughts on the Best Accounting Software in Saudi Arabia

To wrap things up, let’s revisit some of the standout options from our list of the 20 best accounting software in Saudi Arabia. Zoho Books, QuickBooks Online, and Xero are among the top choices that consistently shine due to their robust features and ease of use.

Choosing the right accounting software is a crucial step for effective financial management. I encourage you to start by exploring free trials or contacting software providers to see which one feels like the best fit for your business. Remember, the right software can make a significant difference in how efficiently you manage your finances.

I’d love to hear about your experiences with accounting software! Drop a comment below and share which software has worked best for you.

If you’re feeling overwhelmed by the choices or need help deciding which software is right for your business, don’t hesitate to reach out. I’m here to help!

Promote Sharing: Found this post useful? Share it on social media with fellow business owners in Saudi Arabia who might benefit from it. Let’s help each other find the best accounting solutions!#CRMSoftware #DubaiBusiness #BestCRM #CustomerRelationshipManagement #BusinessSolutions #TechInDubai #SmallBusinessDubai #BusinessGrowth #UAEbusiness #CRMforBusiness #SoftwareSolutions #DigitalTransformation #CRMSystems #BusinessTools #TechForBusiness

FAQs – Best accounting software in Saudi Arabia

What is the best accounting software in Saudi Arabia?

The most popular The best accounting software in Saudi Arabia varies based on your business needs, but top choices include Zoho Books, QuickBooks Online, and Xero. These options offer features like VAT compliance, multi-currency support, and scalability, making them popular among Saudi businesses. software globally is Salesforce, known for its comprehensive features and scalability, making it a top choice for businesses in Dubai as well.

Which accounting standard is followed in Saudi Arabia?

Saudi Arabia follows the International Financial Reporting Standards (IFRS) for financial reporting. This standard helps ensure consistency and transparency in financial statements across businesses.

What is the most popular accounting software?

Globally, QuickBooks and Xero are among the most popular accounting software. They are widely used due to their comprehensive features and ease of use, but the best accounting software in Saudi Arabia might differ based on local needs.

Which accounting app is mostly used in Saudi Arabia?

In Saudi Arabia, QuickBooks Online and Zoho Books are among the most used accounting apps. They offer robust features that cater to the local business environment, including VAT compliance.Salesforce is the biggest CRM provider globally, known for its vast user base and market dominance, including in Dubai.

Does Saudi Arabia use GAAP or IFRS?

Saudi Arabia uses IFRS (International Financial Reporting Standards) rather than GAAP (Generally Accepted Accounting Principles). IFRS is the standard for financial reporting in Saudi Arabia to maintain consistency and comparability.

What is IFRS 9 in Saudi Arabia?

IFRS 9 is an International Financial Reporting Standard that deals with the classification, measurement, and impairment of financial instruments. It is applicable in Saudi Arabia to enhance financial reporting and transparency.

Which software is mostly used in accounting?

In accounting, popular software includes QuickBooks, Xero, and Sage. These platforms are favored for their extensive features, ease of use, and ability to handle various accounting tasks effectively.

What are the three accounting software?

Three prominent accounting software options are QuickBooks, Xero, and Zoho Books. Each of these offers a range of features to manage finances, including invoicing, expense tracking, and tax compliance.

What is SAP software for accounting?

SAP software for accounting is a comprehensive enterprise resource planning (ERP) solution that integrates financial management with other business processes. It provides features for accounting, reporting, and compliance.

What is basic accounting software?

Basic accounting software typically includes essential features like bookkeeping, invoicing, expense tracking, and financial reporting. It is designed for small businesses or freelancers who need straightforward financial management tools.

Is ERP an accounting software?

ERP (Enterprise Resource Planning) is not solely accounting software but includes accounting as one of its many modules. ERP systems integrate various business processes, including finance, inventory, and human resources, into a unified system.

What software do accountants use most?

Accountants commonly use software such as QuickBooks, Xero, and Sage. These platforms are widely adopted for their robust accounting features, including financial reporting, tax management, and payroll.

What is the most used financial software?

The most used financial software includes QuickBooks, Xero, and SAP. These tools are popular for their comprehensive features that support various financial management needs.

Which accounting software is used in Kuwait?

In Kuwait, popular accounting software includes QuickBooks, Xero, and Sage. These options are also used in Saudi Arabia and offer features that cater to local business requirements and compliance.

How do I choose the best accounting software in Saudi Arabia?

To choose the best accounting software in Saudi Arabia, assess your business needs, consider software scalability, evaluate trial versions, and seek recommendations from local businesses. Look for features like VAT compliance and multi-currency support.

What features should I look for in the best accounting software in Saudi Arabia?

Key features to look for include VAT compliance, multi-currency support, cloud access, user-friendly interface, and strong customer support. These features ensure that the software meets local regulations and is easy to use.

Is VAT compliance important for accounting software in Saudi Arabia?

Yes, VAT compliance is crucial for accounting software in Saudi Arabia. Since VAT is a key aspect of business regulation in the region, ensuring that your software can handle VAT reporting and compliance is essential.

What is the difference between cloud-based and on-premise accounting software?

Cloud-based accounting software is accessible online and offers features like remote access and automatic updates, while on-premise software is installed locally on your hardware and provides more control over data but requires manual updates and maintenance.

Can small businesses benefit from using the best accounting software in Saudi Arabia?

Absolutely! Small businesses can greatly benefit from using the best accounting software in Saudi Arabia. It helps streamline financial processes, ensures VAT compliance, and provides tools for effective financial management.

How does multi-currency support benefit businesses in Saudi Arabia?

Multi-currency support is beneficial for businesses in Saudi Arabia that deal with international clients or suppliers. It allows for seamless transactions in different currencies and simplifies financial reporting and reconciliation.

What role does customer support play in choosing accounting software?

Customer support is crucial when choosing accounting software, especially in Saudi Arabia. Reliable support ensures that you can get help with any issues or questions, ideally in the local language, to enhance your software experience.

Are there free accounting software options available in Saudi Arabia?

Yes, there are free accounting software options available, such as Wave and Manager.io. These can be a good starting point for small businesses or startups, although they may have limitations compared to paid solutions.

How can trial versions help in selecting the best accounting software?

Trial versions allow you to explore the software’s features, usability, and compatibility with your business needs before making a purchase. It helps ensure that the software fits your requirements and is user-friendly.

What should I consider when looking for VAT-compliant accounting software?

When looking for VAT-compliant accounting software, ensure it can handle VAT calculations, generate VAT reports, and integrate with local tax systems. This will help you stay compliant with Saudi tax regulations.

How do local business recommendations impact the choice of accounting software?

Local business recommendations provide valuable insights into how well the software performs in a Saudi business context. They can offer real-world feedback on features, usability, and support, helping you make an informed decision.

What is the role of automation in accounting software?

Automation in accounting software streamlines tasks such as invoicing, expense tracking, and reconciliation. It reduces manual effort, minimizes errors, and saves time, allowing businesses to focus on growth.

How important is scalability in accounting software?

Scalability is important because it ensures the software can grow with your business. As your business expands, scalable software can accommodate increased transactions, additional features, and more complex financial management needs.

Can accounting software integrate with other business tools?

Yes, many accounting software options can integrate with other business tools such as CRM systems, inventory management, and payroll software. Integration helps streamline operations and ensures cohesive data management.

How does cloud-based accounting software differ from traditional software?

Cloud-based accounting software is hosted online, offering benefits like remote access, automatic updates, and scalability. Traditional software is installed locally on hardware and provides more control but requires manual updates and maintenance.

What should I look for in customer reviews of accounting software?

When reading customer reviews, look for feedback on the software’s ease of use, reliability, customer support, and specific features. Reviews can provide insights into how the software performs in real-world scenarios and whether it meets user expectations.